What homebuyers and homeowners learned about rates, timing, and strategy in 2025.

2025 Mortgage Rates: What This Year Really Taught Homebuyers and Homeowner

In Houston, we saw buyers hesitate early in the year as rates climbed, then re-enter the market once pricing stabilized and seller concessions increased—especially on new construction and move-up homes.

As 2025 comes to a close, one thing is clear: mortgage rates mattered—but how they moved mattered even more.

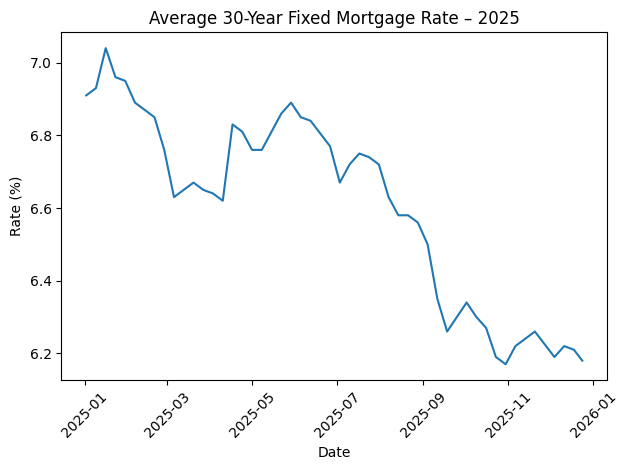

At the beginning of the year, the average 30-year fixed mortgage rate briefly climbed above 7%, creating hesitation among buyers and freezing activity for many homeowners who had grown accustomed to lower rates. By the end of 2025, that same rate had drifted closer to 6.2%, a meaningful shift that quietly changed affordability across the market.

This blog breaks down what actually happened in 2025, what it meant for buyers and homeowners, and how to think about mortgage strategy heading into 2026.

A Look at Mortgage Rate Trends in 2025

Rather than one dramatic move, 2025 was defined by gradual change.

-

Early 2025: Rates peaked just over 7%, driven by inflation concerns and uncertainty around Federal Reserve policy.

-

Mid-Year: Rates stabilized in the mid-6% range as inflation cooled and bond markets adjusted.

-

Late 2025: Rates edged lower and flattened, finishing the year around 6.2%.

For many consumers, this slow decline went unnoticed. But for those actively watching the market, it created windows of opportunity—especially when paired with the right loan structure.

Why the Rate “Headline” Misses the Bigger Picture

A common mistake in 2025 was focusing solely on the headline rate.

Two borrowers quoted the same interest rate often ended up with very different monthly payments due to:

-

Loan structure (fixed vs. ARM, term length)

-

Points or lender credits

-

Credit profile and debt-to-income ratio

-

Property type and occupancy

-

Timing within the rate trend

The reality is that strategy often mattered more than the absolute rate. Buyers who stayed flexible and worked through multiple scenarios frequently outperformed those waiting for a single “perfect” number.

What 2025 Meant for Homebuyers

Despite higher rates compared to prior years, 2025 was not a bad year to buy—it was a selective year to buy.

Successful buyers in 2025:

-

Focused on monthly payment, not just price

-

Used rate buydowns and seller concessions

-

Took advantage of reduced competition

-

Planned refinances strategically rather than emotionally

For many, buying in 2025 meant securing the home first and optimizing the loan later—a mindset shift that proved effective as rates eased.

New buyers should start with the Houston Buyer Guide to understand the full process before choosing loan options.

What 2025 Meant for Homeowners

For homeowners, 2025 reinforced an important truth: refinancing is not only about lowering the rate.

Many homeowners benefited from:

-

Term reductions (30 → 20 or 15 years)

-

Cash-out refinances for renovations or debt consolidation

-

Removing mortgage insurance

-

Improving loan structure for future flexibility

Even without a dramatic rate drop, strategic refinances made sense for the right situation.

Looking Ahead to 2026

No one can predict mortgage rates with certainty. What 2025 showed us is that preparation beats prediction.

Heading into 2026, the most successful buyers and homeowners will:

-

Understand their numbers in advance

-

Monitor trends instead of headlines

-

Use professional guidance to evaluate options

-

Act decisively when opportunities appear

Mortgage decisions are rarely one-size-fits-all. The right answer depends on timing, goals, and structure—not just the rate on a screen.

Final Thoughts

2025 reminded us that mortgage markets reward strategy, not guesswork.

If you are considering buying, refinancing, or simply want a second opinion on your options as we head into 2026, having a clear plan matters more than waiting for perfect conditions.

If you have questions or want to review scenarios specific to your situation, I’m always happy to help.

Ben Helstein

InSync Homes & Loans